The intersection of politics and policy in education right is on display in the debate over whether, and how much, President Biden should forgive federal student debt.

Progressive groups are demanding robust relief. Some want total, some $50,000. The idea of $10,000 is something the President has been warmer to but has not fully embraced. Some want more modest relief, like $10,000. Critics want none at all.

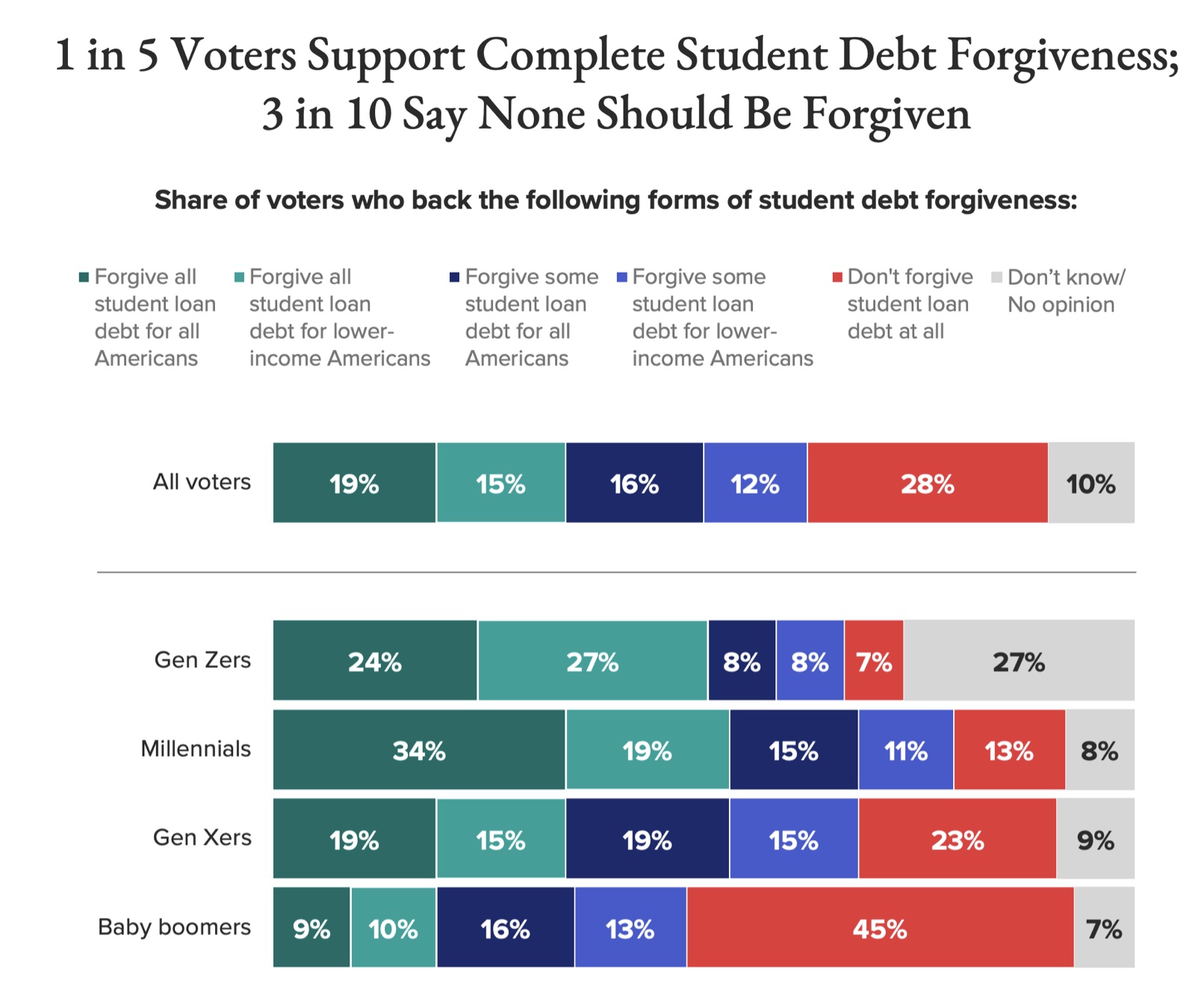

Support for debt relief tends to track, not surprisingly, with age:

So forgiveness as a political strategy seems really obvious to some:

“The White House doesn’t seem to get that their base isn’t just old white people who want to hear ‘Fund the police,’” said Max Lubin, co-founder and chief executive of Rise, Inc., referencing Biden’s recent State of the Union address.

Yeah! Truth to power! Wait, what? Oh yeah, there is something you should probably know about “defund the police,” Val Demmings, James Clyburn, Eric Adams, please call your office. Black Americans pretty consistently tell pollsters they want better and less biased policing, not less.

Here’s a good look at what this illustrates more generally. And here as well. And just Friday we talked about the narrative problem.

So there are actually two issues here. One, there is a positive case to be made for some debt relief. But, two, some of the loudest voices are pretty decoupled from the median Democrat, let alone the median American and that matters to crafting policy – it’s where the policy and politics meet on an issue like this.

In the current environment debt relief has become a mobilization strategy,

“Student debt is really limiting opportunities for millions of young voters who would unsurprisingly feel demoralized if they had an expectation of some action and progress on that front and they haven’t seen it materialize,” he said. “I would put that issue likely at the top of that pyramid in terms of the issue that could have potentially the most impact [on] youth mobilization and motivation heading into the midterms.”

I’d suggest a better political frame would be some sort of reparative strategy. Yes, I get that the word reparative or reparations sends some people into spasms, but those people largely aren’t going to vote Democratic anyway. Here, the target audiences are:

- People with student debt

- The many more Americans who had debt and paid it off or paid their way through

- The even more who didn’t go to college, don’t know a lot of people who did

- Americans in general, who are more likely to be sympathetic to Ohio State than to Oberlin

The second group is an issue. The third, and fourth groups are not small concerns given the problems the Democratic Party is facing politically. People hear working class and think/hear “white working class” but the Democrats’ problem is broader and cross racial/ethnicity. It’s perhaps best summed up by this Intercept headline,

So while loan forgiveness might motivate some voters and help keep Democratic momentum among young voters, we also have to pay attention to the inverse case. It could further cement the idea that Democrats are the culturally insular elite party. And every story of something like this (and there are many) is political catnip for the Republicans and makes college, especially elite colleges, seem othering for a lot of Americans. This means in practice this is not a one way issue. Rather, the valence on what’s “fair” runs in multiple of directions. Many people don’t think it’s fair to use their public dollars to pay off educational debt for others at schools that seem quite distant to them and their families.

It remains contested how much authority the President has to forgive debt, and Biden would clearly prefer Congress acts instead, but that seems unlikely. One way things die in Washington is everyone points at someone else and says, ‘I agree with the goal, but they should do it.’ Another concern was that debt forgiveness is not stimulative and has small multipliers. But that’s a 2020 problem not a 2022 problem when policymakers are focused on restraining inflation.

The reason it’s not stimulative, though, owes to the demographics of debt holders, which matter here. We tend to report debt in average terms but median debt is a better measure – and in both cases it’s only debt for people holding it. Most students don’t. And the averages are skewed by graduate and professional school debt, where the case for relief is weakest and the politics the most treacherous. It’s also skewed by elite schools and paying off the debt of kids at Harvard, Princeton, and other fancy schools is an awfully tough sell. These data are a few years old but the directional trends still apply:

At the same time this points up why the case for a $10,000 debt relief is strongest. That’s where you have a lot of people who, as Bill Clinton used to say, tried hard and played by the rules (he said work hard but it’s the same idea). And there was clearly some predatory behavior and generally bad behavior, not just by the for-profits. The Department of Education is working to address some of the skeezy behavior by for-profit higher ed, but it’s a broader issue.

And it’s where a reparative frame would have some traction. Those people with less than $10,000 who didn’t get a degree are worse off than if they had not attended at all. Economically, higher education is not like healthy eating where even a little bit is better than nothing. Relief for that group would also benefit a diverse group of Americans and analysts estimate it would fully clear about a third of borrowers. Was each of those borrowers duped? No, of course not, some just made bad choices or had other factors intercede. But we’re talking about a broad government policy, it’s hard to discern that sort of thing and clearing this sort of useless debt has some merit regardless. Clear debt for small borrowers and sidestep all the unsympathetic examples that arise when you start clearing debt for wealthier borrowers – at a time many Americans are concerned about their own economic prospects.

Bundle that targeted relief up with some meaningful economic measures for Americans who did not go to college (after the pandemic experience I’d start with more forgiveness and support for entry level health care roles like EMTs and CNAs as well as paramedics and other community health professionals and things along those lines but there are a few ways you could do this) and then you’ve got a package that can get some traction while minimizing political liabilities. It would also force the Republicans to ante up.

Otherwise, student debt relief can be like a political water balloon, you push one place and get a reaction somewhere else. That’s something Democrats can ill-afford given the macro political environment and the stakes of the next two elections where most of all they should think about winning.